Makro in sektorske analize za podporo pri bolj premišljenem in utemeljenem sprejemanju odločitev.

Filtri

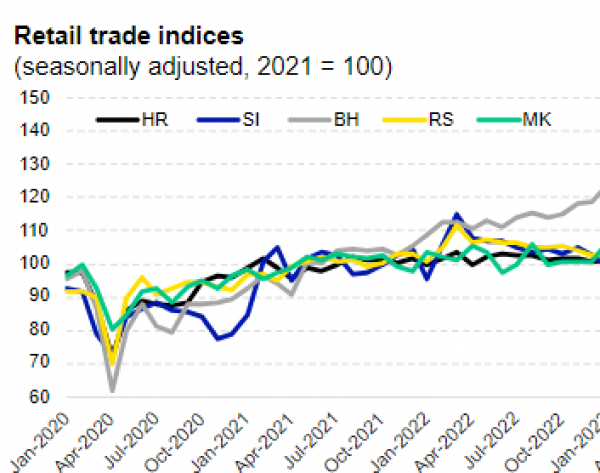

Retail trade - Retail trade rebounding, driven by strong fundamentals

Real retail trade trends are rebounding in 2024, after slower 2023 digits hit by high inflation and uncertainty impaired consumption sentiment. As the inflation slowed down, the spending mood has improved, providing support for the retail trade growth. Spending fundamentals have positive contribution, with growing real wages and employment rise.

26.07.2024.

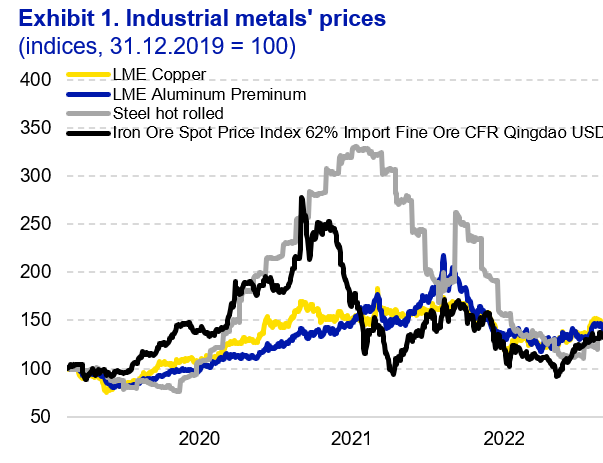

Adria region metals industry: Corroding sales and razor thin profitability

The largest metal producers in the region felt the sting of the global downturn in metal prices. Sales growth melted away and profitability potential was slim at best. Excess supply arose as the collective industry issue. In this report we dive into the details behind the sales downturns and explore how procurement methods, end user markets and production processes create divergence in performance.

11.07.2024.

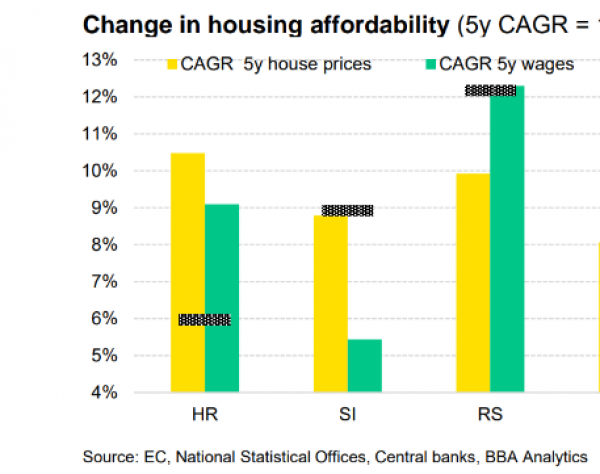

Construction and Real Estate - Sector continues to grow, despite chronic labour shortage

In early 2024, Croatia and Serbia saw double-digit growth in construction, driven by infrastructure projects and earthquake reconstruction, while B&H and N. Macedonia experienced slight growth, and Slovenia's growth slowed due to a high base effect. Labour shortages are a significant issue, particularly in Slovenia and Croatia, leading to increased reliance on foreign workers. Wage growth has improved housing affordability in the last couple of years in Serbia and N. Macedonia but decreased it in Croatia, B&H and Slovenia.

05.07.2024.

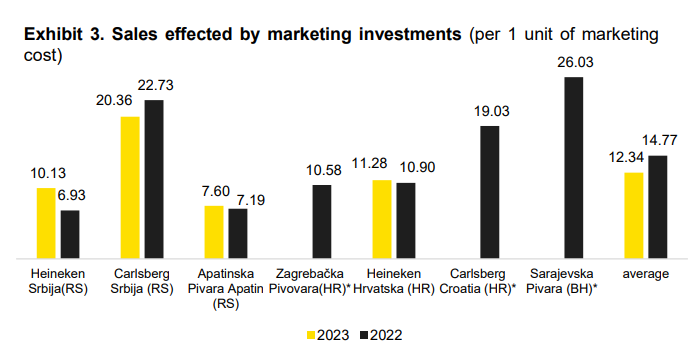

Beer industry: Harnessing economies of scale for brewery profitability

The beer market, both globally and within the Adria region, is one of the most consolidated markets with dominant market players. The Adria region has become an attractive market for global players since 2000, when local beer-producing companies became part of global companies such as Carlsberg, Heineken, and Molson Coors.

28.06.2024.

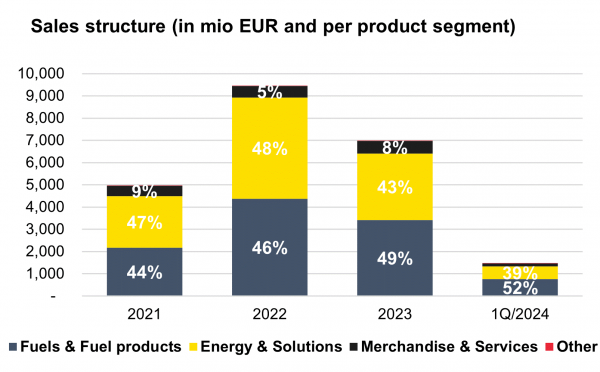

Petrol Group - Navigating regulatory challenges

Over the past three years, Petrol has experienced significant fluctuations in revenue and profitability, particularly in 2022, when it achieved a record-high revenues while simultaneously incurring net loss. Despite drop in sales, profitability significantly recovered in 2023. Prices of energy products stabilized below previous year’s level, leading to lower input costs and easing of price regulations. While it seemed that bad times were behind Petrol, it is evident that 2024 will be another challenging year due to new regulation of oil derivative prices.

21.06.2024.

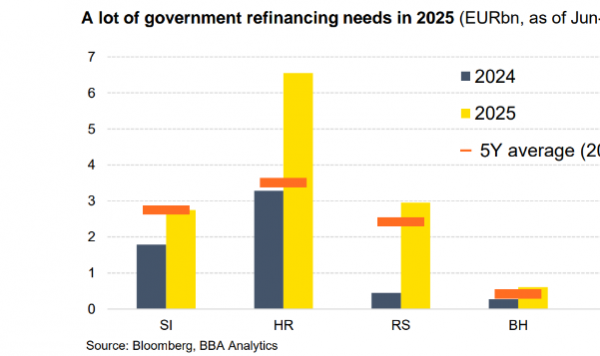

Adria Region Macro Quarterly 3Q 2024 - Sustained growth and fiscal resilience ahead

The Adria region is expected to maintain solid GDP growth in 2024, driven by robust domestic consumption, rising wages, and infrastructure investments, particularly in Slovenia and Croatia. Events like Expo 2027 in Serbia will boost economic activities. Recovering external demand will also lift exports across the region. Fiscal policies in the Adria region will remain expansive in 2024, supporting public investments and social spending, but will gradually slow in 2025 due to fiscal consolidation. EU funds will be crucial for investments, especially in Croatia and Bosnia and Herzegovina.

14.06.2024.

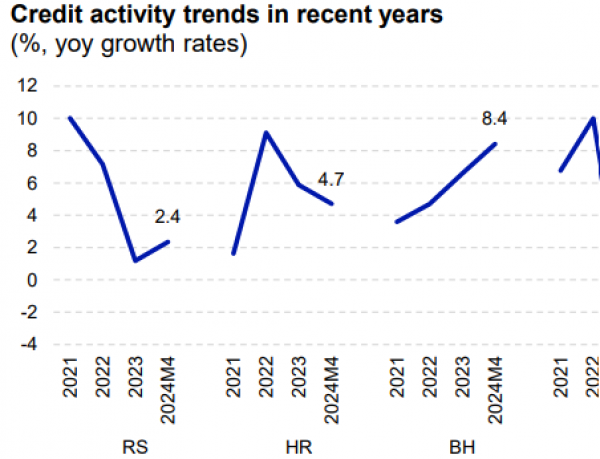

Credit activity and interest rates - Credit stock to go up, interest rates on a crossroad

Credit activity trends are showing signs of recovery despite elevated interest rates. Although tighter monetary policies were implemented, their impact through the credit channel was limited. This was due to the excess liquidity within financial systems, which prevented a credit crunch and only caused a slight slowdown.

07.06.2024.

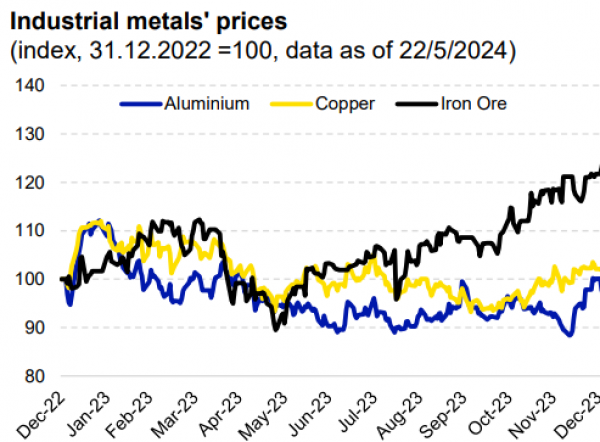

Commodity market - All eyes on FED

The commodities market in 2024 has been shaped by global factors, with varying performances among metals. Copper and aluminium have gained due to their roles in decarbonization and China's economic measures, while iron ore has declined due to China's real estate issues.

24.05.2024.