Makro in sektorske analize za podporo pri bolj premišljenem in utemeljenem sprejemanju odločitev.

Filtri

Markets report - Equity & Bonds - Geopolitical noise, regional signal: why Adria stands out

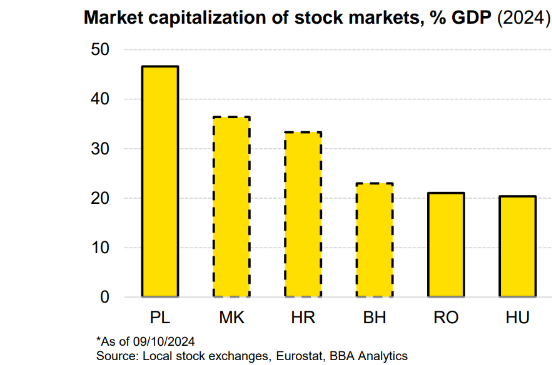

Year 2025 began with heightened volatility across global financial markets, primarily stemming from the United States, where Trump’s renewed protectionist moves, including new tariffs, have unsettled investor sentiment. Within this backdrop, equity markets in the Adria region have delivered mixed results year-to-date.

29.05.2025.

Adria Region Macro Quarterly 2Q 2025 - Uncertainties elevated, but growth to continue

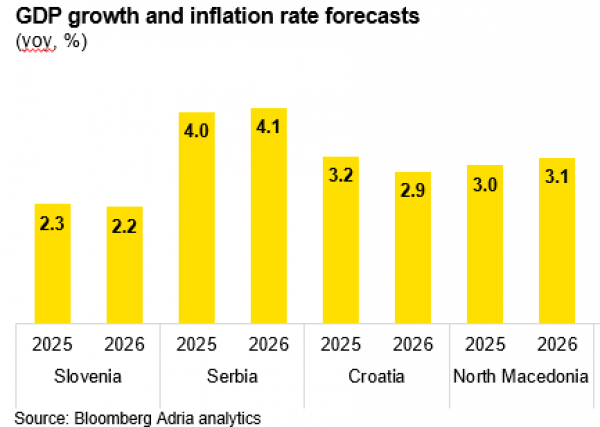

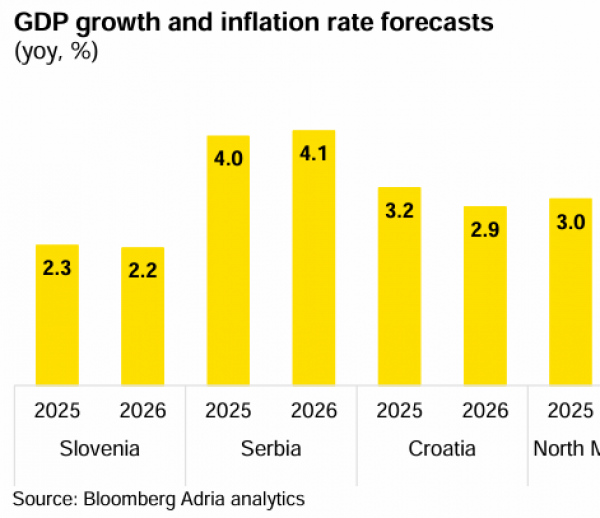

We expect the Adria region to continue its growth momentum in 2025 and 2026. Domestic demand will continue to contribute strongly due to firm spending fundamentals. Labour markets are tight, and availability of a work force is one of the key issues in the mid term. Main risks to our projection come from the external environment.

13.03.2025.

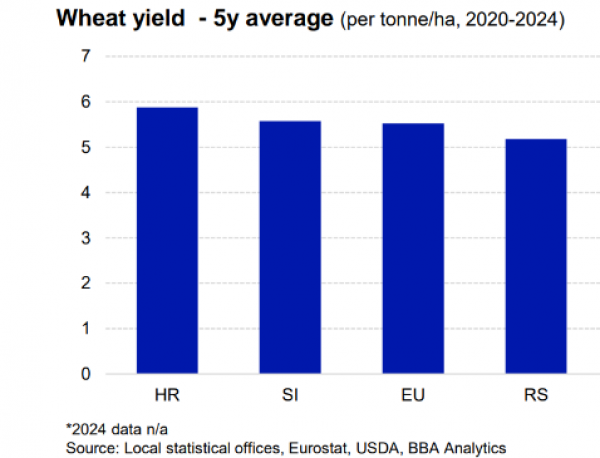

Agri commodity market - Diseases and weather are shaping the prices

The price of sugar has fallen by 17% over the past year. All cereals are highly dependent on weather conditions and Russian/Ukrainian exports. Currently, there are no significant adverse weather conditions or major risks to cereal exports via the Black Sea. As a result, the FAO Cereal Price Index fell by 6.9% year-over-year, with all cereals at lower levels. Meat prices, as measured by the FAO Meat Index, have fallen by 8.1% over the past year.

13.02.2025.

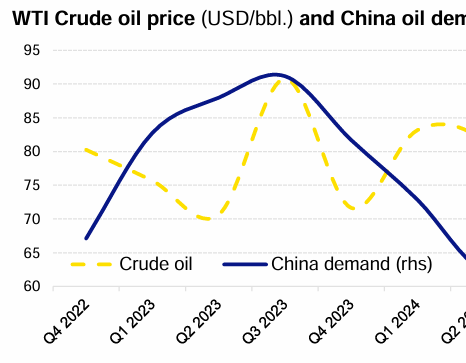

Commodity market - Trump and weather to navigate the prices

Copper and aluminium prices were elevated in 2024. Copper prices were cca 10% higher on average in 2024 (till mid Dec-2024), aluminium 7% yoy for the same period. China is a common denominator for industrial metals, so government stimulus provided a boost to the copper price mid-year. Aluminium exposure to the automobile production sector limits the upside, with protective measures imposed impacting the flow directions.

19.12.2024.

Adria Region Macro Quarterly 1Q 2025 - Growth on track, external risks lurk

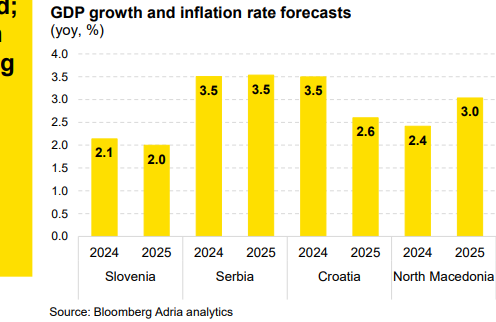

The Adria region will continue its growth trend, based on stable consumption growth, infrastructure investments, and a external demand rebound. Tight labour markets will support continued wage growth and provide support to the domestic demand, while one of the key risks remain tied to the external demand. Especially, as the crisis in the German auto industry unwinds further, and protective measures spread globally.

12.12.2024.

Markets report - Equity & Bonds - Positive trends persist amid solid economic growth

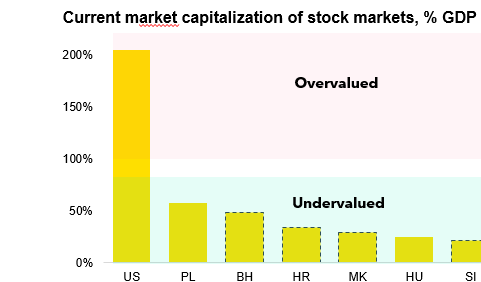

Equity indices in the Adria region have continued their growth year-to-date, outperforming most CEE indices. The only index showing negative performance is BIRS, reflecting concerns of overvaluation. Positive sentiment around moderate real economic growth has translated into improved company results. In terms of bonds, the risk premium has fallen year-to-date compared to German benchmark, further signaling the good shape of regional economies and improved investor sentiment towards Adria region bonds.

18.10.2024.

Adria Region Macro Quarterly 4Q 2024 - Moderate growth and stabilizing inflation ahead

The Adria region is seen to experience moderate economic growth in 2024, supported by robust domestic consumption, ongoing infrastructure projects, and improving external demand. This growth is expected to continue into 2025, fuelled by ongoing infrastructure investments, a recovery in external demand, and stable domestic consumption. Fiscal policies across the region will remain expansionary in 2024, with a focus on public investment and social spending. However, by 2025, a gradual shift towards fiscal consolidation is anticipated, especially in Slovenia and Croatia, as governments work to manage budget deficits.

06.09.2024.

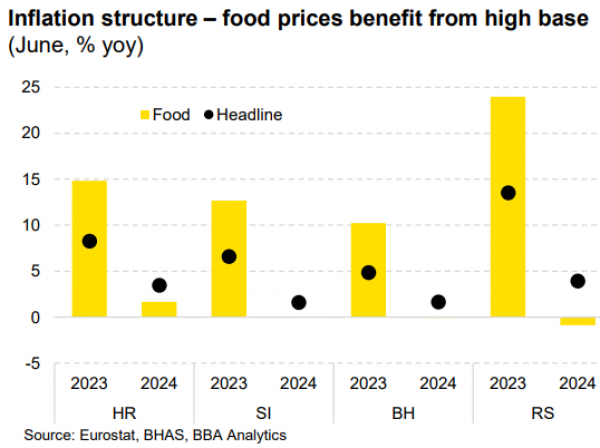

Inflation report - Services running the show

Inflation has slowed in the Adria region, as the prices have been converging to their elevated levels. Calming of external pressures has allowed the prices to relatively stabilize, compared to the previous years. Even though the monetary policies have tightened, the transmission was slow and burdened by high liquidity of the banking systems.

16.08.2024.