Makro in sektorske analize za podporo pri bolj premišljenem in utemeljenem sprejemanju odločitev.

Filtri

Still solid demand – are we at the pricing peak?

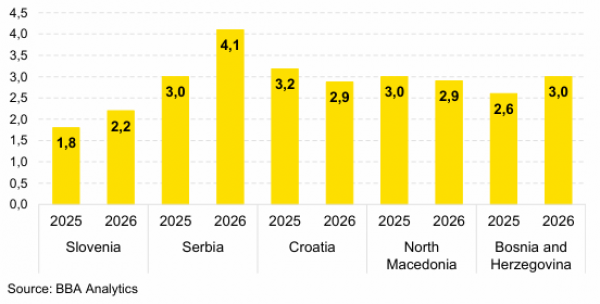

Construction remains one of the key pillars of the Adria region’s economies, accounting on average for 5.5% of GDP, with Croatia leading at 6.7% in 2025, supported by EU funds, post-earthquake reconstruction and strong infrastructure investment. In recent years, the sector has strengthened its macroeconomic importance and productivity, with average value added per construction worker rising to €32,000 in 2024, €9,000 more than in 2019, lifting regional productivity to 52% of the EU27 average.

12.02.2026.

Commodity Report - Metals and Oil&Gas

2026 will likely see energy markets grappling with oversupply and transition pressures, while metals - precious and industrial - continue to ride structural demand trends and supply limitations, reinforcing their role as strategic assets in a volatile macro environment.

29.12.2025.

Markets Report - Equity & Bonds

The global bull market continued in 2025; however, rising geopolitical and macroeconomic risks further underline the importance of portfolio diversification. In this environment, the Adria region stands out as an attractive investment alternative, offering more favorable valuations and solid fundamental support compared with most developed markets.

19.12.2025.

Domestic Demand Carries the Adria Region Forward

Growth across the Adria region remains resilient but uneven toward the end of 2025, with domestic demand and construction acting as the main pillars, while external demand and investment dynamics remain mixed.

16.12.2025.

Macro Quarterly_ 4Q 2025- Stable Growth Ahead, External Headwinds Remain

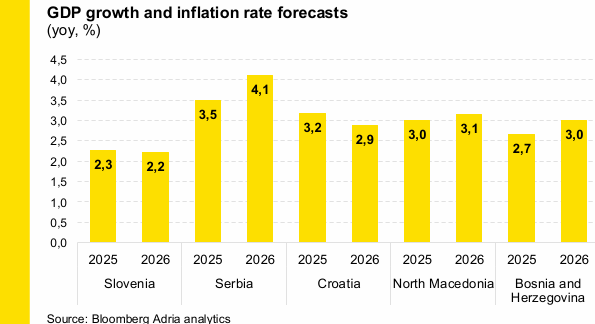

We expect the Adria region to remain on a stable growth path in 2025, supported by resilient domestic demand, rising real incomes, and firm labour markets. Croatia and North Macedonia posted 3.4% y/y GDP growth in Q2, led by household spending and construction. Bosnia and Herzegovina, and Slovenia benefited from strong consumption, though Slovenia's rebound remains fragile due to falling retail sales and weak EU trade. Serbia’s Q2 growth accelerated to 2.1% y/y, lifted by consumption and services, while construction and investment lagged. Across the region, labour shortages remain structural constraints.

22.09.2025.

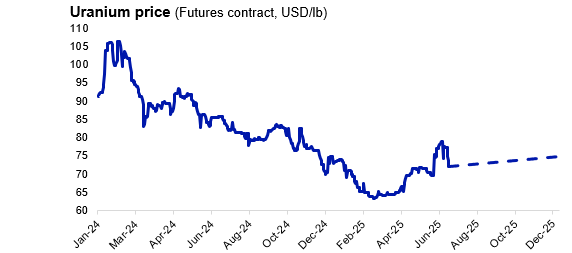

Commodity market - Commodities at a Crossroads: Gold Shines, Oil Slumps, Uranium Waits

After peaking at $107/lb in 2024, uranium prices have corrected sharply to double digit numbers. The sharp pullback has caught many investors off guard; however, the pullback reflects macro-driven sentiment shifts, policy uncertainty, and technical selling, not a breakdown of uranium’s long-term bull thesis. In fact, several core market indicators continue to point to tightening fundamentals, reinforcing the long-term structural case. Rather than signalling the end of the cycle, the current price action appears to be a temporary pause in an otherwise intact uptrend.

11.07.2025.

Adria Region Macro Quarterly 3Q 2025 - Growth holds, but headwinds remain

We expect the Adria region to remain on a stable growth path in 2025, driven by domestic demand, rising real incomes, and solid labour markets. Household spending and construction activity continue to support GDP across Croatia, Bosnia and Slovenia, while Serbia and North Macedonia also benefit from strong credit dynamics. The main drag remains external demand, with weaker EU growth and export volatility limiting the contribution from trade. Workforce shortages remain a common structural issue across all economies.

24.06.2025.

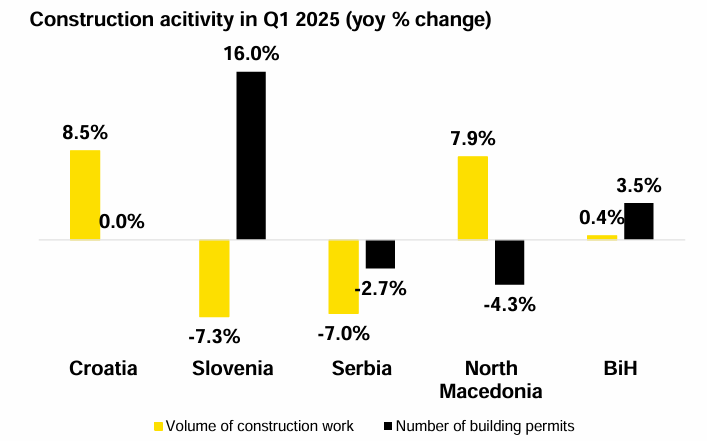

Construction and real estate - Uneven construction trend across Adria countries

Construction activity in the Adria region continues to be primarily driven by residential and non-residential building construction, as the growth rates in building construction are higher than in civil engineering.

29.05.2025.