Makro in sektorske analize za podporo pri bolj premišljenem in utemeljenem sprejemanju odločitev.

Filtri

Bonds & Equity - 2022 Market Wrap-up & 2023 Market Outlook

Entering the late hours of the year highlighted by risk aversion amid geopolitical crisis and fight against a multi-decade inflation spike, and since December is traditionally not the month of big market moves, we are making a wrap-up of the 2022 market performance for Adria region.

05.12.2022.

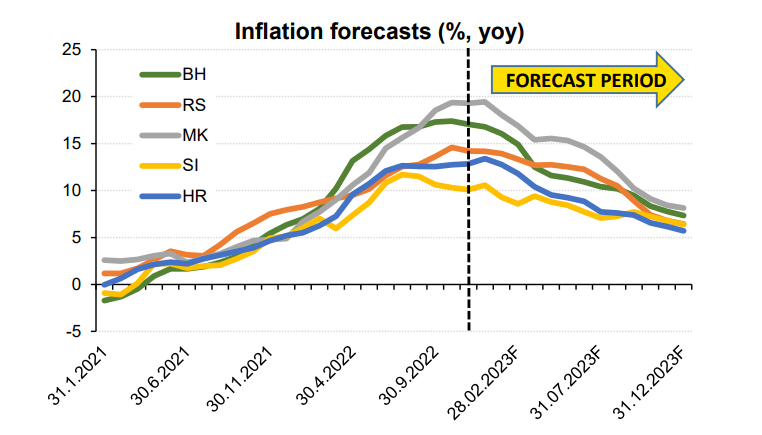

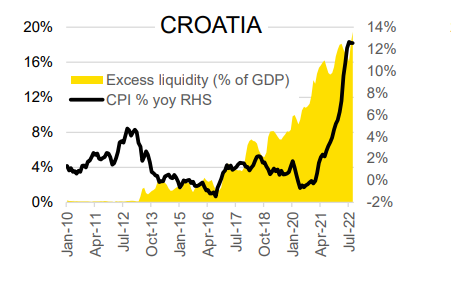

Inflation report – Two Sides Of The Same Coin

Annual inflation rate in October gained pace across the region, bar Slovenia, where it mildly slowed, and averaged around 15%. At the same time, core inflation rate averaged around 13% (data for Bosnia unavailable), hence slowly but surely creeping to headline rate.

30.11.2022.

Interest rate forecasts - Interest rates rising until mid of 2023

The central banks are in the midst of policy tightening, with consumer inflation speed-up showing only limited (if any) signs of abating. We are examining the trajectory and presenting forecasts for the key interest rates until end of 2023.

23.11.2022.

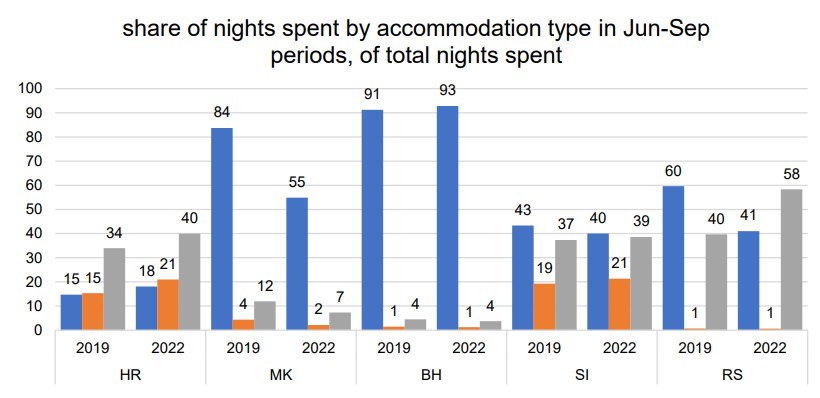

Tourism report - Tourist activity in region nearing record year of 2019

Observing the summer months of June-September 2022, total tourist arrivals and overnight stays in Adria region advanced strongly on a yoy basis. Overall growth in arrivals was seen from +20.9% yoy in Slovenia to +40.3% yoy in Bosnia and Herzegovina, while nights spent advanced by +15.8% yoy in Slovenia to +30.9% yoy in Serbia.

18.11.2022.

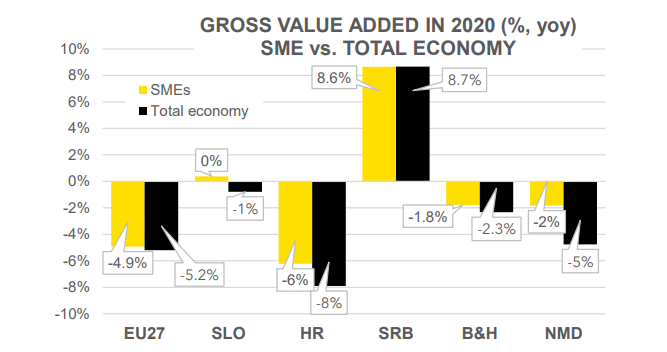

SME insight - SMEs Contribute Strongly To Adria Economic Output

Small and medium enterprises are seen as defining the structure of each economy’s activity. Given that majority of employees in each economy is engaged into the SME business, we are testing the Adria region’s ability to withstand economic turnarounds via the contribution of SME sector to the overall economy.

14.11.2022.

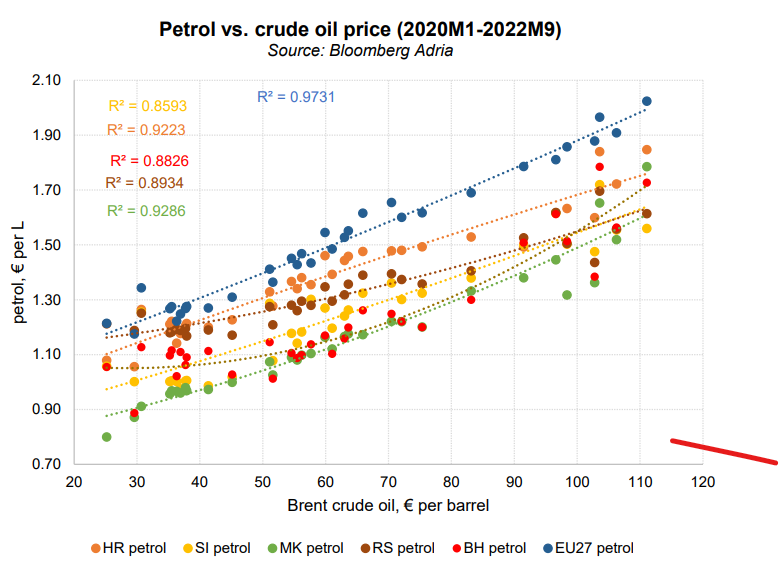

Energy costs for households - Energy prices for households rising throughout Adria region

Prices of electricity and gas for households in the region vary due to economic development level of each country, as well due to unique means of production/import, costs of production, transmission, distribution, subsidies and some specific factors, such as weather conditions, especially regarding Croatia, where hydro energy accounts for more than 50% of electricity production.

14.11.2022.

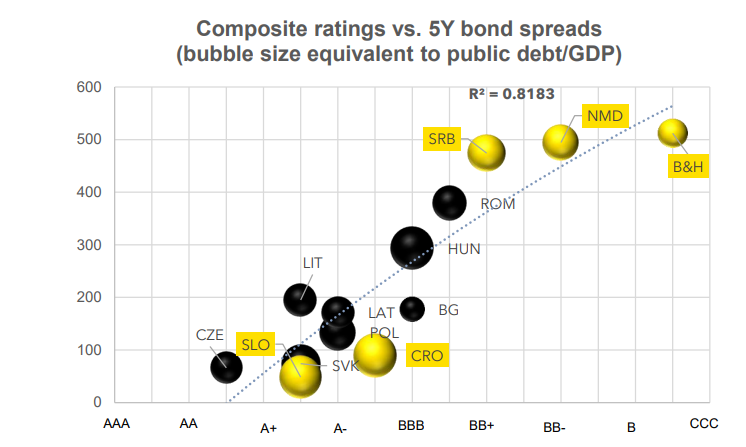

Bond spreads and credit ratings - Are investors and rating agencies on the same page?

Despite the last week’s corrections driven by the Fed hawkish tone, returns of the key global equity indexes still signal some stabilization in risk appetite recently. Indeed, S&P 500 is up by around 5% over the last four weeks as investors apparently see some attractive price levels to manage their investment exposures.

10.11.2022.

Retail trade - Inflation taking a toll on retail trade

Even though nominal retail trade in the Adria region continued on a high note (posting double-digit growth rates), stubborn inflationary pressures, which influenced real disposable incomes, took a toll and forced retail trade on a real-term basis to a slowdown path.

04.11.2022.